Some Known Facts About Independent Investment Advisor copyright.

Table of ContentsHow Independent Investment Advisor copyright can Save You Time, Stress, and Money.Getting The Independent Financial Advisor copyright To WorkNot known Facts About Investment RepresentativeThe Single Strategy To Use For Investment ConsultantThe Investment Representative DiariesHow Private Wealth Management copyright can Save You Time, Stress, and Money.

“If you're to buy something, state a tv or a computer, you would want to know the specifications of itwhat tend to be their parts and just what it can perform,” Purda explains. “You can think about buying monetary information and support in the same manner. People need to know what they're buying.” With monetary information, it's important to keep in mind that the item isn’t ties, stocks or other financial investments.

it is things like cost management, planning for retirement or reducing debt. And like purchasing some type of computer from a trusted organization, consumers need to know they truly are purchasing financial information from a trusted expert. One of Purda and Ashworth’s best results is about the costs that financial coordinators charge their customers.

This presented true it doesn't matter the fee structurehourly, payment, possessions under administration or flat fee (into the study, the dollar property value fees ended up being the same in each case). “It nonetheless comes down to the value proposition and doubt from the consumers’ part that they don’t know very well what they have been getting back in exchange of these charges,” says Purda.

Retirement Planning copyright Things To Know Before You Buy

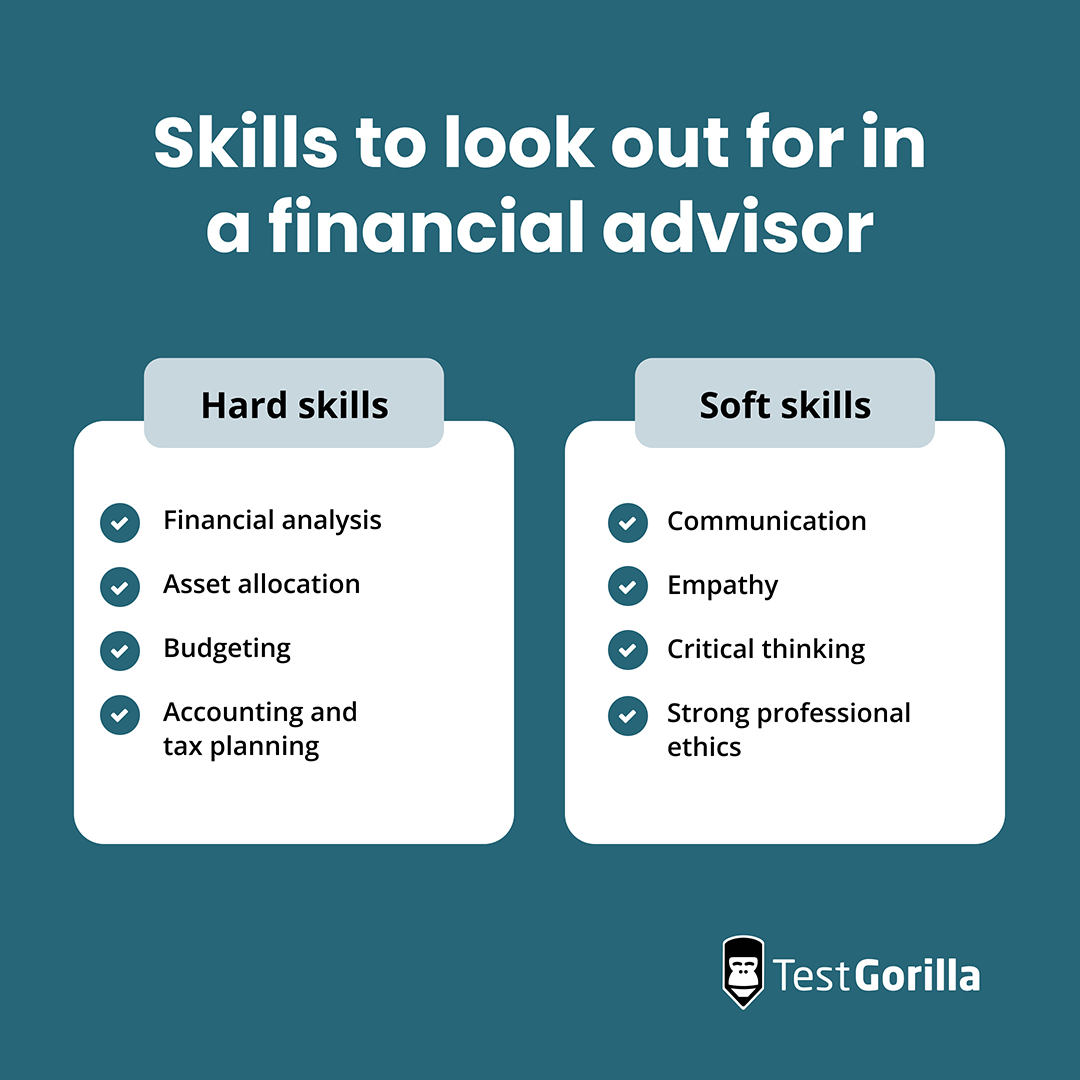

Tune in to this informative article whenever you listen to the term monetary advisor, just what pops into the mind? A lot of people think of a professional who is able to provide them with monetary guidance, specially when you are considering investing. That’s an excellent place to start, although it doesn’t color the total image. Not really near! Monetary analysts can help people with a bunch of other cash goals as well.

A financial advisor can help you build wealth and shield it for your lasting. They're able to calculate your own future financial needs and plan approaches to stretch your own pension cost savings. They could also advise you on when you should start tapping into personal safety and using money in your retirement accounts to help you avoid any horrible penalties.

The 45-Second Trick For Retirement Planning copyright

Capable allow you to ascertain what shared resources are right for you and demonstrate how exactly to handle to make the absolute most of your assets. They can in addition guide you to see the risks and just what you’ll should do to realize your aims. A seasoned financial investment professional will also help you remain on the roller coaster of investingeven whenever your assets get a dive.

They can give you the assistance you should create plans to ensure that your desires are performed. While can’t place an amount tag from the reassurance that accompany that. Relating to a recent study, the typical 65-year-old pair in 2022 needs to have around $315,000 stored to pay for health care costs in pension.

9 Easy Facts About Independent Investment Advisor copyright Explained

Since we’ve reviewed exactly what economic advisors carry out, let’s dig to the various sorts. Here’s a rule of thumb: All financial planners are monetary analysts, but not all advisors tend to be coordinators - https://urlscan.io/result/90650ebe-d515-427e-a278-4ec73e89a1c2/. An economic coordinator centers on helping individuals develop plans to achieve long-term goalsthings like beginning a college fund or conserving for a down repayment on a house

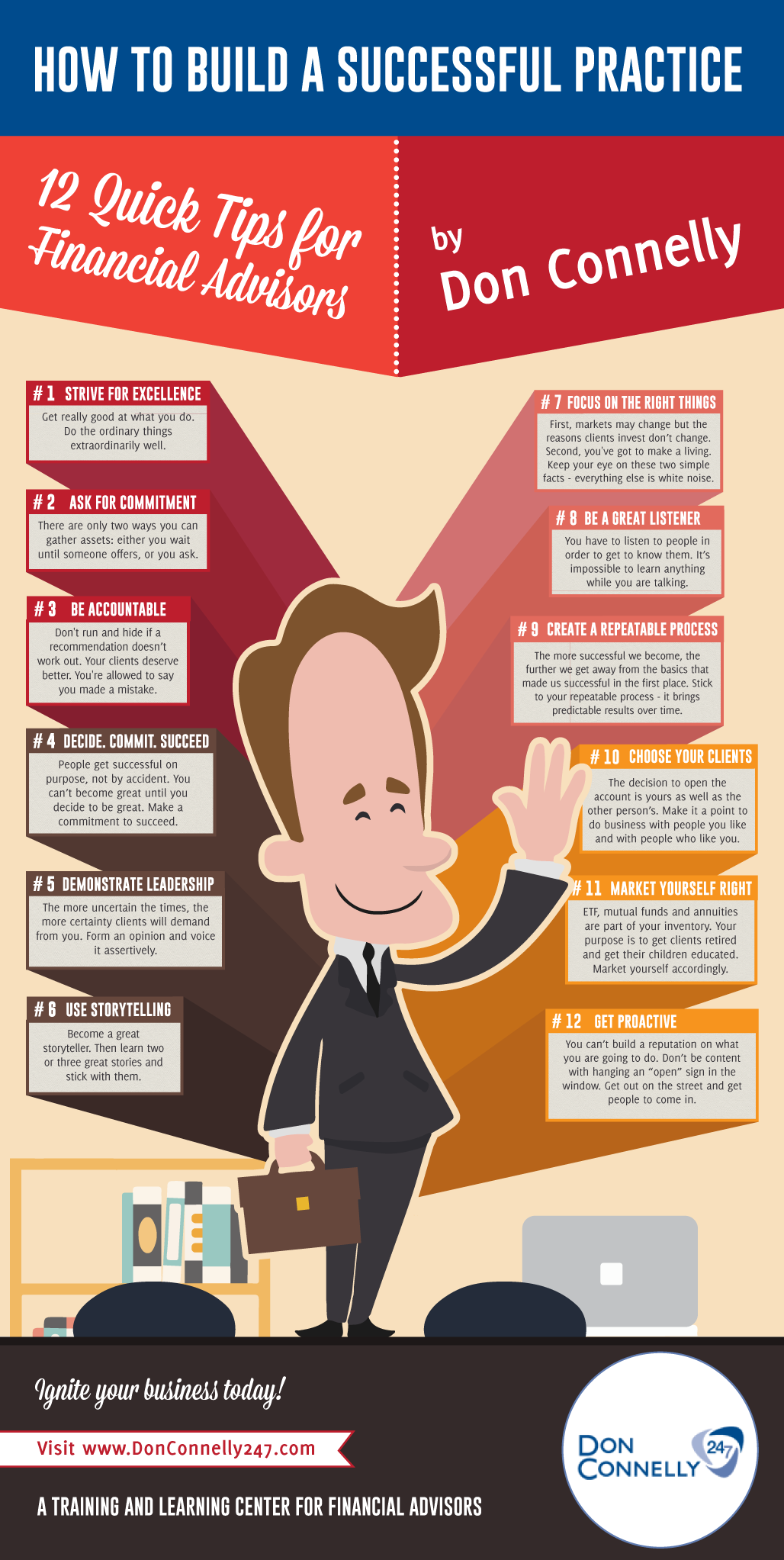

How do you know which financial specialist is right for you - https://ca.enrollbusiness.com/BusinessProfile/6539368/Lighthouse%20Wealth%20Management,%20a%20division%20of%20iA%20Private%20Wealth? Listed below are some actions you can take to make sure you’re employing best person. Where do you turn when you yourself have two terrible choices to pick? Effortless! Discover more options. More choices you have got, a lot more likely you will be in order to make a good choice

Retirement Planning copyright for Beginners

All of our Smart, Vestor system makes it possible for you by showing you as much as five monetary advisors who is able to last. The good thing is, it’s completely free to get connected with an advisor! And don’t forget to come quickly to the interview prepared with a list of questions to inquire of to decide if look here they’re a great fit.

But listen, because an expert is smarter compared to the typical keep does not give them the authority to tell you what you should do. Often, advisors are full of themselves because they convey more degrees than a thermometer. If an advisor starts talking-down for your requirements, it's time for you to suggest to them the entranceway.

Just remember that ,! It’s essential as well as your monetary consultant (whoever it ends up getting) are on the exact same page. You need a specialist that has a long-lasting investing strategysomeone who’ll motivate you to definitely hold investing constantly whether the marketplace is up or down. independent investment advisor copyright. In addition don’t wish to utilize someone who forces you to buy something which’s as well risky or you are not comfortable with

Get This Report on Private Wealth Management copyright

That blend will give you the variation you'll want to effectively invest when it comes to longterm. Whenever study monetary experts, you’ll probably come across the definition of fiduciary task. All of this indicates is any specialist you hire must act such that benefits their particular customer and never their self-interest.

Comments on “Examine This Report about Lighthouse Wealth Management”